Filing of Income Tax Return

Services

- Sole Proprietorship Registration

- Partnership Firm Registration

- Company Registration

- Filing of Income Tax Return

- Sales Tax Registration & Return Filing

- Tax Appeals & Litigation

- NTN Registration

- LCCI Membership Registration

- WeBoc Registration

- Trademark Registration

- Copyright Registration

- Drafting Legal Agreements & Contracts

- IT Company & Call Center Registration

- PEC Registration

- PRA Registration

CORTAX is a Tax Advisory Consultant Firm that provides affordable tax filing services. If your corporal affairs need extensive enlisting, the form filling seems like a hectic job with numerous sections and subsections to cover. CORTAX offers the best income tax services, under which our Client upload and our professional experts will examine and prepare Income Tax Return draft.

What is Income Tax?

Tax is an involuntary fee imposed on an individual or a corporation by the federal government. It can be local, regional, or even national. Income tax is a highly consistent form of taxation. According to the prevailing law, all Persons must file income tax every year, which comes under the liable Persons for filing Income Tax returns.

The government collects Income Tax for the utilization of this fund on those works, which are the most important at that time. CORTAX is one of the best income tax consultants in Lahore, assisting the clients with matters on taxation. Income tax helps out to reduce the economic disparity of any country. Tax rates and calculation techniques to calculate taxable income are always different as per the financial status of the Taxpayer. Taxpayers are of several types; some of them are as follows.

- Companies

- Association of Persons (AOP)

- Salaried individuals

- Non – Salaried Individuals

For an individual, Filing an income tax return in Pakistan is a tiresome and unexciting process for an individual who wished to file its Tax Return. Preparing Tax Return involves lengthy and tricky methods to calculate taxes and writings, for which people spent too much time on the solution. It usually becomes an annoying experience for the person who works on it. The reasons behind Things that used in these calculations are generally not aware of the general public. Further, there is always a deadline for filing Tax Returns for which the process becomes more uncomfortable. The details on income tax return filing in Pakistan issued by the Federal Board of Revenue, Pakistan.

Who Needs To File Income Tax Returns in Pakistan?

Following is a list of persons that are required to submit an Income Tax Return for a tax year under Income Tax Ordinance (2001). Check if you fall into any of these categories.

- Every registered company in Pakistan

- An individual (other than a company) who has a taxable income exceeds the minimum limit, which is Rs. 400,000/- (Four Hundred thousand Rupees only)

- A non-profit organization commonly called NPO

- A welfare institution.

- An individual who is the owner of immovable property with a specific area (two hundred and fifty square yards or more)

- Every individual who is the owner of Motor Vehicle above 1000 CC Engine capacity.

- Every individual who has a National Tax Number

- Every individual which owner of commercial or industrial electricity connection.

Benefits of Income Tax Return filing in Pakistan

- Help to avoid Penalties

- Claim Tax Refunds

- Proof of Legal Income and Address

- Helpful in Easy Loan processing from banks

- Helpful during Application of visa processing for reconciliation of income

- Carry forward losses

What is Wealth Statement?

The following types of companies’ investors may set up in Lahore:

Every Resident Person needs to submit his Wealth Statement along with reconciliation for that particular year under which he is filing Income Tax Return. Particulars of Wealth Statement includes,

- Personal Assets and Liabilities of an Individual.

- Assets and Liabilities belong to Spouse, children, and Minors. In case the person got Dependent his/her Assets and Liabilities as well.

- Gifted assets, sold, or transfer during the year to any other person during the particular Tax Year.

- Detail of total expenses spent by Person, Wife, Children’s, and Dependents during the Particular year

- The Reconciliation of Wealth with the previous year and income of the current year.

What are Tax Refunds?

A Person can claim refunds if he has filed his income Tax return online. The manual filer of income tax return is not entitled to get any refund.

Your Income Tax Refund amount should clearly state in FBR online System (IRIS). Applications for refunds are filed separately in FBR online IRIS system within two years from the date of filing return or Tax Payment date, whichever is later, and for the status of Application Taxpayer has to visit his Regional Tax Office in FBR.

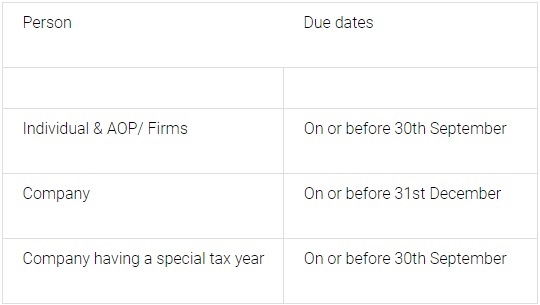

Income Tax Due Dates

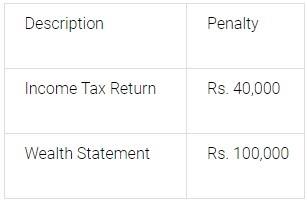

The Penalty for Non-Filing Income Tax Return and Wealth Statement

When an individual fails to file Income Tax Return within the due time, he has to pay penalty.

Cases When Income Tax Returns Is Unsuccessful

Remember, your Income Tax Returns will not entertain in some instances. According to the Income Tax Ordinance 2001, every individual and company must possibly ensure the correct filling of Detail and Figures Tax Return Forms. Wrong information may result in the imposition of penalties in Individuals. Before filing tax Returns, try to make sure of the following guidelines.

- CNIC should be valid

- All the mandatory fields on the Tax should file correctly, not be empty.

- Tax Return should be adequately signed/ verified by the Taxpayer or its representative.

- Taxes should adequately paid, and CPR Numbers should be correct.

How CORTAX can help you in filing Tax Return

CORTAX is an Income tax consultant Firm in Lahore that provides affordable tax filing services. If your corporal affairs need extensive enlisting, the form filling seems like a hectic job with numerous sections and subsections to cover.

CORTAX is proving the best income tax filing services in Lahore and surrounding regions. Usually, our Clients upload their documents for Tax filing, or our system and our tax experts analyze those documents to find out about Tax adjustments and saving. After scrutinize and preparing the tax return, we offer a chance to review by the client for cross-checking all the input information before the final submission of the income tax return.

Our professionals always try to make your Tax Returns easy and filed within time, which reduces the risk of Audit from the Tax department.